A clinician recently asked me to explain how Acute Kidney Injury (his particular area of interest) impacted on the Trusts income position. Given that Acute Kidney Injury (AKI) rarely occurs in isolation, and from our Trust’s experience appears as a secondary diagnosis almost twice as often as it appears as the primary diagnosis, the question proved quite tricky to answer.

The question did involve a deep dive into the intriguing world of the, almost mythical, Code to Group spreadsheet, so I thought I would take the opportunity to tell the AKI story and help explain how the spreadsheet works and how income is therefore determined.

If you want to follow along you will need two documents from the NHS Digital’s National Casemix Office. Follow the link called “Code to group and user manual”.

- Code to Group User Manual

- Code to Group Spreadsheet

Acute Kidney Injury

This is sudden damage to the kidneys usually as a complication of another serious illness that results in a ranging severity of kidney function loss, from minor impairment to complete kidney failure.

It typically occurs when blood flow to the kidneys is restricted or drainage from the kidneys is impaired as a result of an enlarged prostate or enlarged pelvic tumours.

As AKI tends to be secondary to a presenting complaint it is not at all surprising that it tends to appear in patients records or in the coding of the patients episodes and spells as a Secondary Diagnosis.

How is the Income Determined?

First of all, the record of the patients stay needs to be “coded” which is the process by which clinical coders review the notes and other clinical records and assign procedure (OPCS codes) and diagnosis (ICD10) codes to the patient’s electronic record.

This coded record for the patients entire spell in hospital is then passed to the grouper which is an algorithm that outputs a spell HRG (Health Resource Group) which can then be assigned a tariff or price.

The grouper is a black box piece of software and you can’t actually see what happens with it but fortunately the Code to Group spreadsheet splits out the stages so you can work through the process of assigning an HRG.

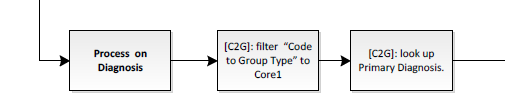

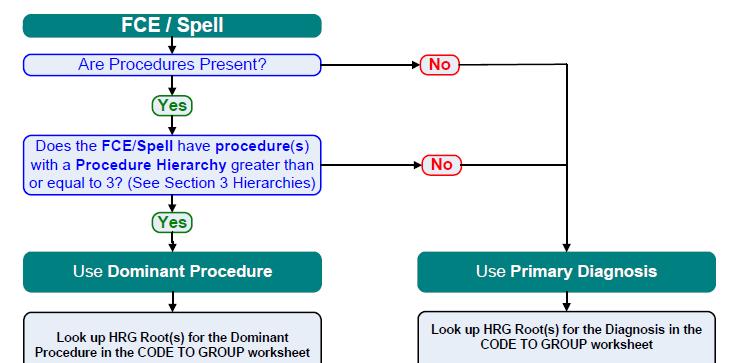

You need to work closely with the User Manual to ensure you follow the correct grouping process. The first stage is to determine whether the spell will be grouped based on the dominant procedure or the primary diagnosis.

Procedures take precedence when they have a hierarchy score greater than or equal to 3. This broadly means anything vaguely surgical ends up being grouped according to the procedure route and anything medical goes down the diagnosis driven grouper route.

You can see the “Hierarchy lists” in the Code to Group spreadsheet - it is a combined list showing OPCS and ICD10 codes so you need to make sure you are looking at the right type - there is an overlap in codes used.

From our experience, the vast majority of patients with an AKI diagnosis recorded, are medical patients with minimal procedures and tend to be grouped on the basis of primary diagnosis code.

This exploration of the Code to group spreadsheet will now focus on the Primary Diagnosis Grouper Methodology.

Primary Diagnosis Code to Group Methodology

Now we know that this is a diagnosis process we can go to tab “Code To Group” and filter column CC (Code to Group Type) to Core1.

Then in the Code column we filter for our Primary Diagnosis code.

Diagnosis Code for Acute Kidney Injury

The ICD10 coding classification for AKI is N17.9 Acute renal failure, unspecified.

As an income accountant, I’m not really qualified to determine the ICD10 code. I can check the ICD10 list which is on the iPhone app Ref NHS or I can open the Code to Group spreadsheet and look at the tab ICD-10 but I won’t find Acute Kidney Injury listed. Thats’s where you need to ask your clinical coders whose expertise is translating diagnoses into the relevant codes. In this case, the clinician was also very familiar with the ICD code for AKI.

What is the HRG when Acute Kidney Injury is the Primary Diagnosis?

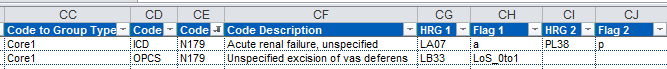

So, back in the “Code to Group” tab we need to filter on Code = N179 which results in two rows, one of which is the diagnosis we are interested in and the other is for a procedure that shares the same code. We are only interested in the Code Type = ICD

Reading across we can that the base HRG is LA07 for an adult or PL38 for a child.

Now, HRG codes are 5 digits long not 4, so we aren’t finished yet.

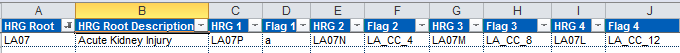

We need to move along to the next tab “Group to Split” and then filter for the 4 digit HRG root that we have just determined. If we assume we are dealing with an adult AKI patient we will filter on LA07.

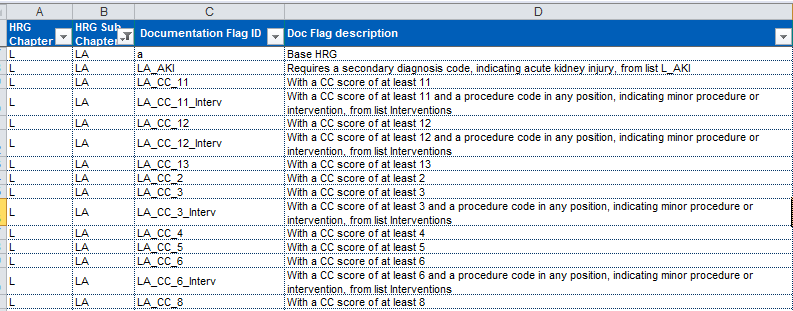

This now reveals a series of HRG codes (7 in total) with corresponding flags, that represent conditions that need to be met in order to acquire the given HRG.

You need to start at the right hand side and work left, reviewing the criteria for each flag. The highest flag met determines the full HRG code.

The “Documentation Flags” tab reveal the criteria required. So for example flag LA_CC_12 requires a CC score of at least 12 but if that isn’t met you then need to check flag LA_CC_8 which requires a CC score of at least 8, then 4 and if that is not met it remains at the base HRG of LA07P.

CC or Co-morbidity and Complication Scores

Not all diagnosis codes actually count in the CC scores tagged on the end of an HRG and the score (from 0 to 2) depends on the HRG chapter concerned. For example, Essential Hypertension is a complicating factor in 30 HRG chapters but not in LA Renal Disorders.

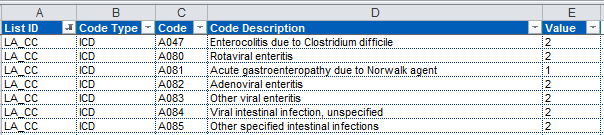

In order to calculate the CC score you need to check all the diagnosis codes present in the patient record in the tab “CC Lists”. Filter on the relevant List ID first, in this case LA_CC and hunt for the ICD code, repeat for all ICD codes and add them up.

Once you’ve determined which flag is met you have revealed the final HRG code. If you want to know how much you will be paid for the patient you need to refer to the latest National Tariff workbook - or you can use that marvelous NHS Ref app.

What Impact does Acute Kidney Injury have on Income when it is not the Primary Diagnosis?

We have already identified the fact that AKI is not the primary diagnosis in most cases, so the process I have outlined above is not entirely useful…..

Where AKI contributes to the overall CC score of the HRG chapter and results in it tipping from the base HRG to a more complex version, it will have a corresponding income impact for the Trust. Determining what this value, is a little tricky.

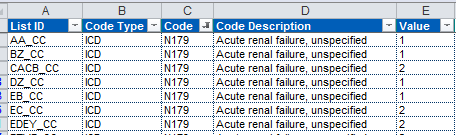

First we need to confirm that N179 does contribute to the CC score. Go to The “CC Lists” tab and filter on Code = N179. This reveals that AKI does contribute to the score in 41 HRG chapters (interestingly not in LA Renal Disorders), and its score varies between 1 and 2.

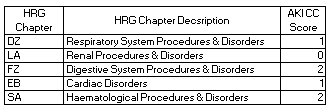

From our data I can see that the most common HRG chapters where AKI forms a secondary diagnosis are DZ - Respiratory, LA - Renal, FZ - Digestive and EB - Cardiac and the CC scores differ for each.

If we want to estimate how much the N179 code contributes in each case we need to try and estimate the extra value in each CC score. Tariff varies hugely across a chapter so we have to review this at HRG root.

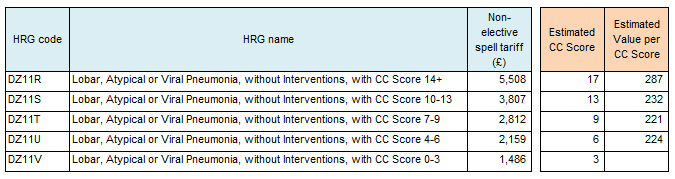

Here’s an example of my estimates for the DZ11 root. Because each HRG covers a range in CC scores it is not possible to calculate precisely but I estimate that in this case, each CC score results in an average of £241. Its also worth noting that its a stepped relationship as you need to tip into the next bracket in order to release this income.

So we’ve been able to use the code to group spreadsheet in conjunction with the national tariff workbook to estimate the impact of additional non-primary diagnosis codes on the income payable to Trusts.

One of the reasons for doing this analysis would be to identify the potential impact of improving the coding and ensuring that all diagnosis codes are captured. Although this would be subject to counting and coding change restrictions embedded in the NHS Standard contract and have a very delayed impact on income, it is always beneficial to improve the accuracy of recording.

Perhaps a more important reason for unpicking the potential financial impact of the code is to support a business case for service change. I believe that AKI is potentially under-recognised in hospitals, if specialist nurses were employed to identify and appropriately treat patients with this condition, their care would improve with Length Of Stay potentially reduced. The increased identification could in part, fund itself through the enriched case mix. I suspect this would not fall foul of the counting and coding change restrictions as it would have resulted from a clear service change and patient care would improve.